multistate tax commission form

The Multistate Tax Commission has created a Uniform Sales and Use Tax Exemption Certificate to meet this need and the MTC multistate tax. The Multistate Tax Commission or MTC recently published amendments to their Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 This statement provides guidance from the MTC to states regarding which online activities should and should.

Draft Model Uniform Statute On Multistate Tax Commission

Any states that request to be removed or do not respond will be removed from the revised form.

. The Multistate Tax Commission is an interstate instrumentality located in the United States. Exception - Beginning January 10 2022 a drop shipper may accept a resale number issued by the sellers state on an exemption certificate when the drop shipped sale is sourced to Tennessee. Form 402 Instructions Individual Apportionment for Multistate Businesses paid by subtenants.

The MTC is requesting responses and revisions from the participating states by November 30 th 2020. This multijurisdiction form has been updated as of February 4 2022. Loretta King Multistate Tax Commission 444 N.

As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. For example if the project was 30 complete at the end of the tax year 30 of the bid price should be included in the gross receipts. On average this form takes 14 minutes to complete.

Electrical and telephone utilities use a single-weighted sales factor. Form 402 Instructions Individual Apportionment for Multistate Businesses completed at the end of the tax year. Multistate Tax Commission MTC created a model statute for reporting adjustments to federal taxable income and federal partnership adjustments.

The seller may be required to provide this exemption. 86-272 income tax immunity. Ohio accepts the Exemption Certificate adopted by the Streamlined Sales Tax System.

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. The Multistate Tax Commission MTC is updating its Public Law 86-272 guidance Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States under Public Law. Multistate Tax Commission June 13 2018 Page 1 of 10 June 13 2018 Ms.

The instructions on the form indicate the limitations Ohio and other states that accept this certificate place on its use. This form may be obtained on the Multistate Tax Commissions website. Sovereignty members are states that.

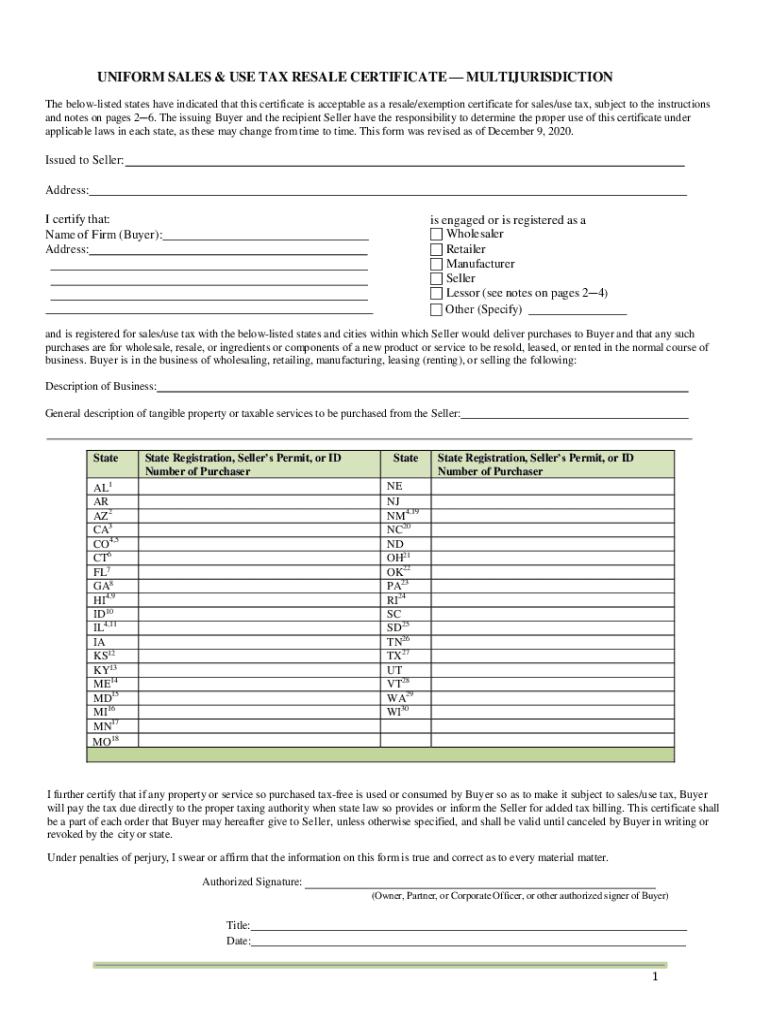

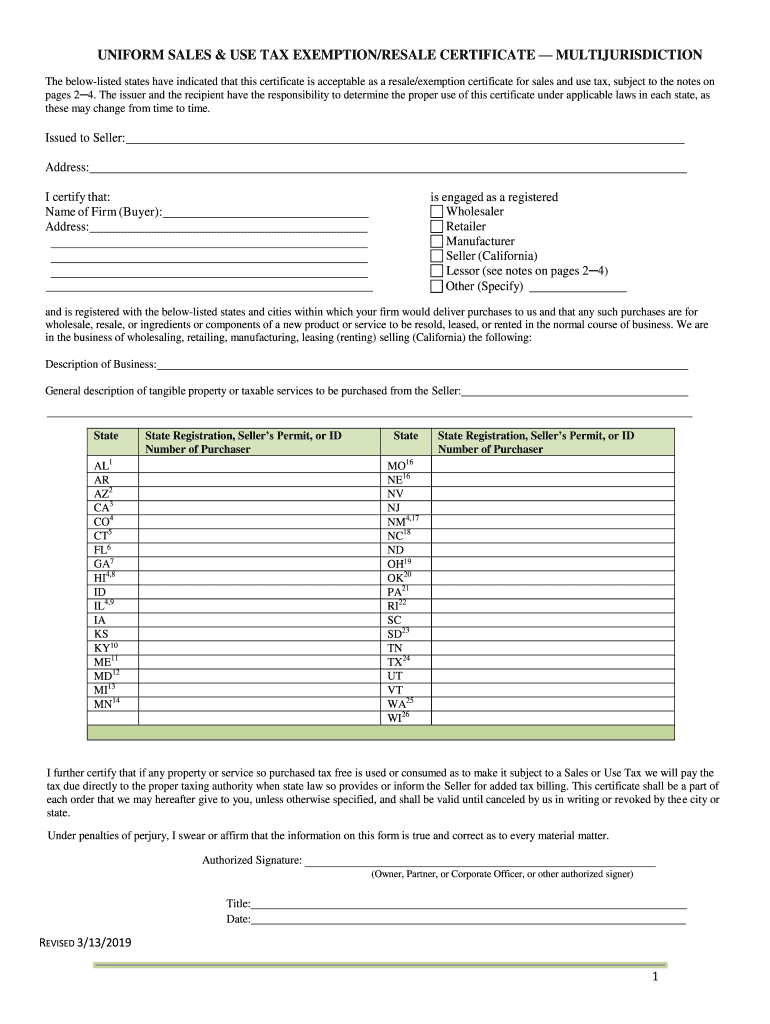

The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate. Other Minnesota Sales Tax Certificates. Multistate Tax Commission MTC Draft Model Sales and Use Tax Notice and Reporting Statute Dated April 25 2018 Dear Ms.

SMART TAX USA - The Multistate Tax Commission MTC As the Internet continues to grow and interstate commerce increases the need for a printable multistate tax form that taxpayers can download online also continues to increase. The Uniform Sales Use Tax Certificate - Multijurisdiction form contained in this publication is owned by the Multistate Tax Com mission. This is a multi-state form.

How-to Use Multistate Tax Commission MTC Forms. Created by the Multistate Tax Compact the Commission is charged by this law with. The proposed draft of the revised form can be found here.

Commission members acting together attempt to promote uniformity in state tax laws. This tutorial video goes over how-to configure accepted states on the Multistate Tax Commission MTC form in EXEMPTAX. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

Information regarding the Multistate Tax Commission and this form may be obtained from their website at wwwmtcgov. Capitol Street NW Suite 425 Washington DC 20001-1538 Re. Gross receipts from a construction project are attributable to Idaho if the construction is.

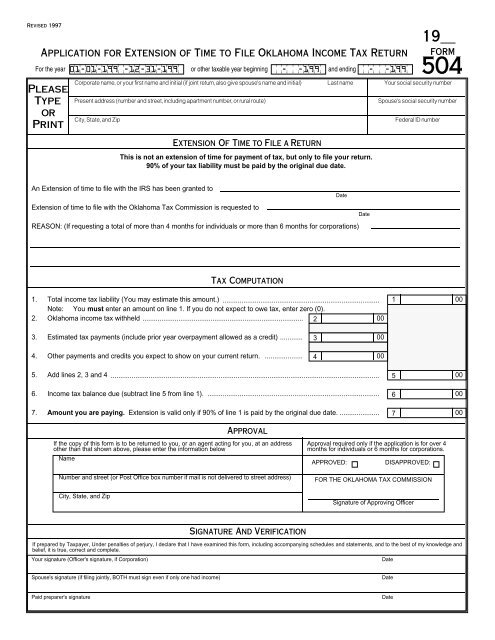

Many companies use it even for documenting exemptions in only one state mostly because it is so widely available. If playback doesnt begin shortly try restarting your device. This form may also be downloaded form the Oklahoma Tax Commission website at wwwtaxokgov under business.

The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws that apply to multistate and multinational enterprises. Commission staff are not authorized to answer questions regarding specific States nexus standards or other aspects of their registration requirements. The UNIFORM SALES USE TAX RESALE CERTIFICATE MULTIJURISDICTION Multistate Tax Commission form is 2 pages long and contains.

However the selling dealer must also obtain a resale authorization number from the. SalesTaxHandbook has an additional two Minnesota sales tax certificates that you may need. Videos you watch may be added to the TVs watch history and influence TV recommendations.

Tennessee drop shipment Rule 96 requiring a Tennessee resale number is repealed effective January 10 2022. Definition of Member States Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law These states govern the Commission and participate in a wide range of projects and programs. Streamlined Sales and Use Tax Agreement Certificate of Exemption.

The MTC is now updating the form to reflect the Wayfair decision and states new sales and use tax economic nexus laws. Arizona Form 165PA which allows the partnership to pay specifically only applies to adjustments from a federal exam. It is the executive agency charged with administering the Multistate Tax Compact.

The Commission serves as a central source for state sales and use tax vendor registration forms and instructions for taxpayers who have determined that they are obligated to register or choose to do so voluntarily. The Certificate itself contains instructions on its use lists the States that have indicated to the Commission that a properly filled out form satisfies. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL.

Streamlined Sales Tax System Certificate of Exemption. The MTC MJ is the standard form to which most people refer when discussing the MultiJurisdiction form also sometimes called the MTC MJ Multi-J or just Multi. Not all states allow all exemptions listed on this form.

By Jennifer Kruppa CPA Tax Associate. Allows the Multistate Tax Commissions Uniform Sales and Use Tax Resale Certificate Multijurisdiction for tax-exempt purchases for resale. An additional multi-state version of the SST Certificate as provided by the Multistate Tax Commission can be found here.

Sales Factor The sales factor is double weighted for all taxpayers except electrical and telephone utilities. Subrents arent deducted if theyre business income.

Draft Model Uniform Statute On Multistate Tax Commission

Multistate Tax Commission Home

Uniform Sales And Use Tax Exemption Certificates Accuratetax Com

Multistate Tax Commission Home

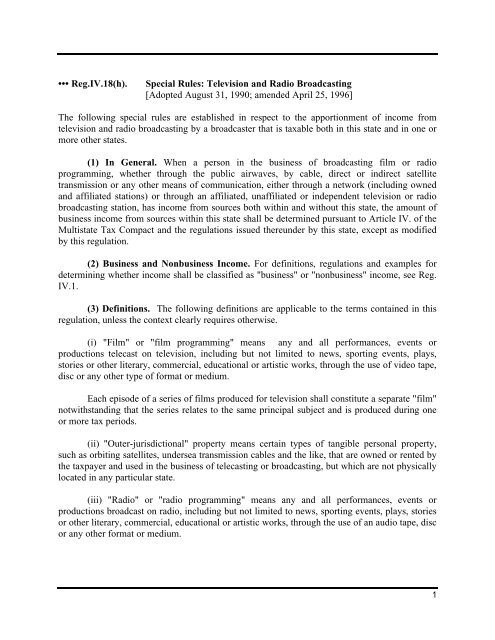

Special Rules Television And Radio Broadcasting Multistate Tax

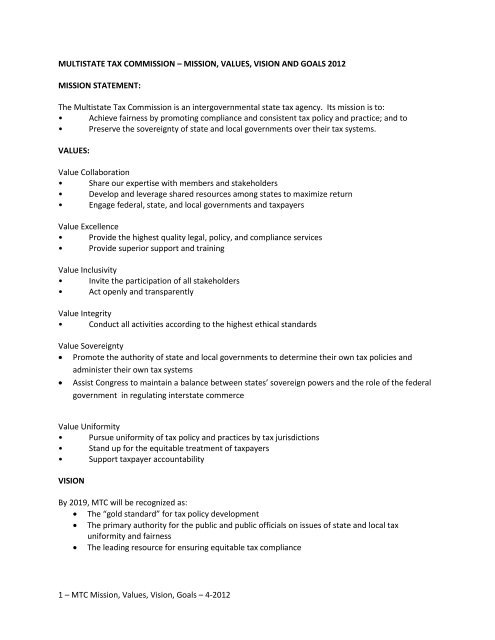

Mtc Mission Values Vision Goals Multistate Tax Commission

Form 504 Oklahoma Tax Commission

Multistate Tax Commission News

Mtc Form Fill Out And Sign Printable Pdf Template Signnow

2020 2022 Mtc Uniform Sales Use Tax Certificate Multijurisdiction Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Recent Multistate Tax Commission Guidance May Increase Tax Burden On Multistate Tangible Property Sellers Mlr

Free Form Uniform Sales And Use Certificate Free Legal Forms Laws Com

Mtc Uniform Sales Use Tax Exemption Resale Certificate 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Multi State Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller