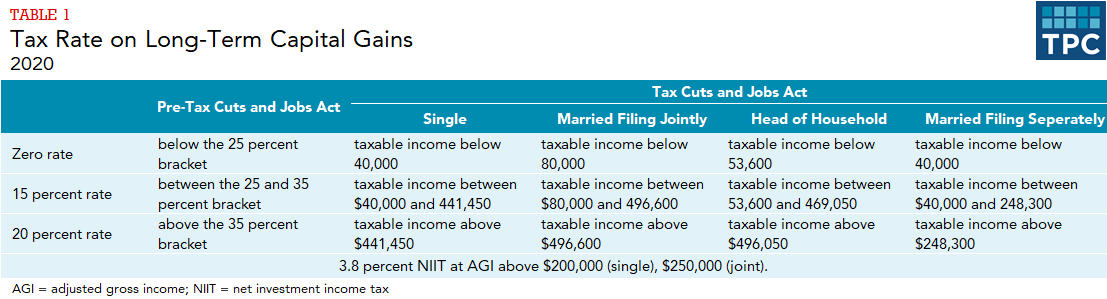

capital gains tax increase in 2021

Whats new for 2021. 75 basic 325 higher and 381 additional.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The IRS also charges high-income individuals an additional net investment income tax NIIT at.

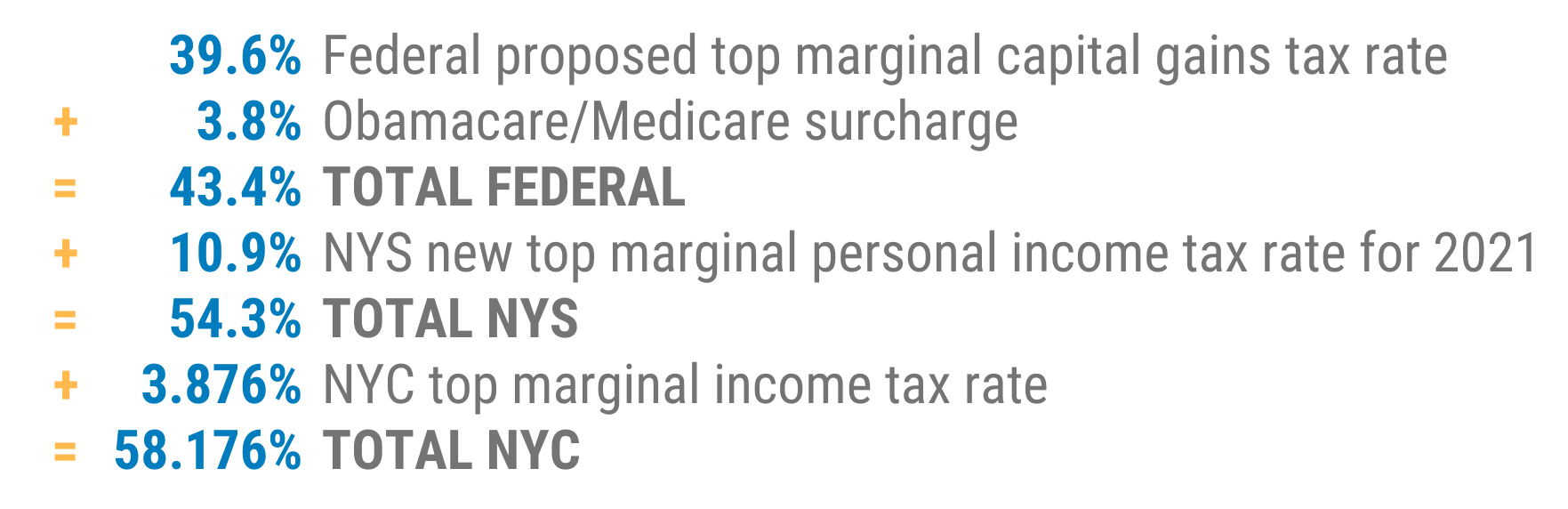

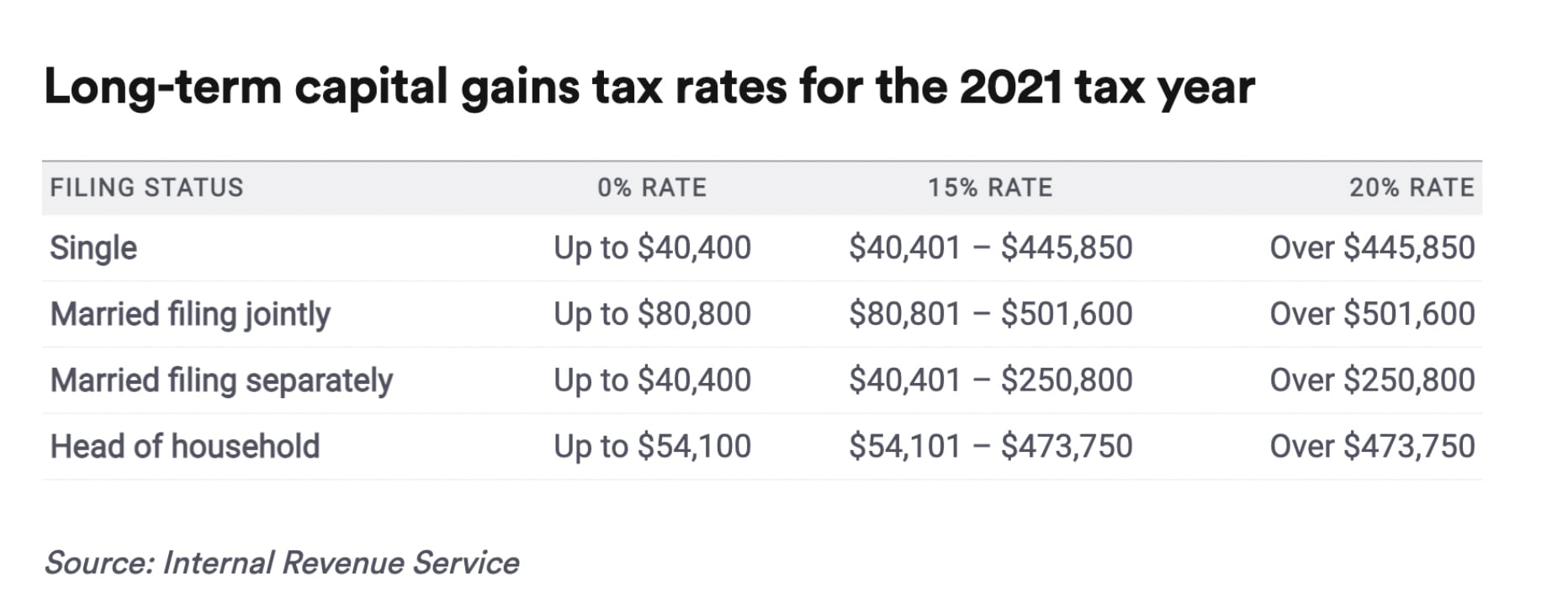

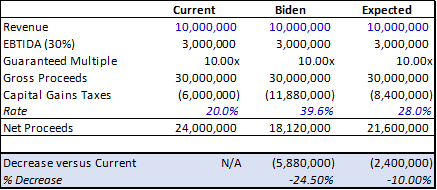

. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The top rate would jump to 396 from 20.

The dividend tax rates for 202122 tax year are. Moreover such a tax hike wouldnt even accomplish the desired goal of increasing revenue. More than 80 percent of gains.

Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit. The effective date for this increase would be September 13 2021. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

The Times reports that the Chancellor is considering an increase in the dividend tax rate by 125 and a cut to the 2000 tax-free dividend allowance perhaps halving it. Yet for those with capital gains in lower income. Will capital gains tax go up in 2021.

What is the dividend tax rate for 2021. While it is unknown what the final legislation may contain the elimination of a rate. These taxpayers would have to pay a tax rate of 396 on long-term capital gains.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. However it was struck down in March 2022. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

The proposal would increase the maximum stated capital gain rate from 20 to 25. President Biden will propose a capital gains tax increase for households making more than 1 million per year. To summarize many of the OTS proposals did not pass however we can see there are some increases in tax for capital gains.

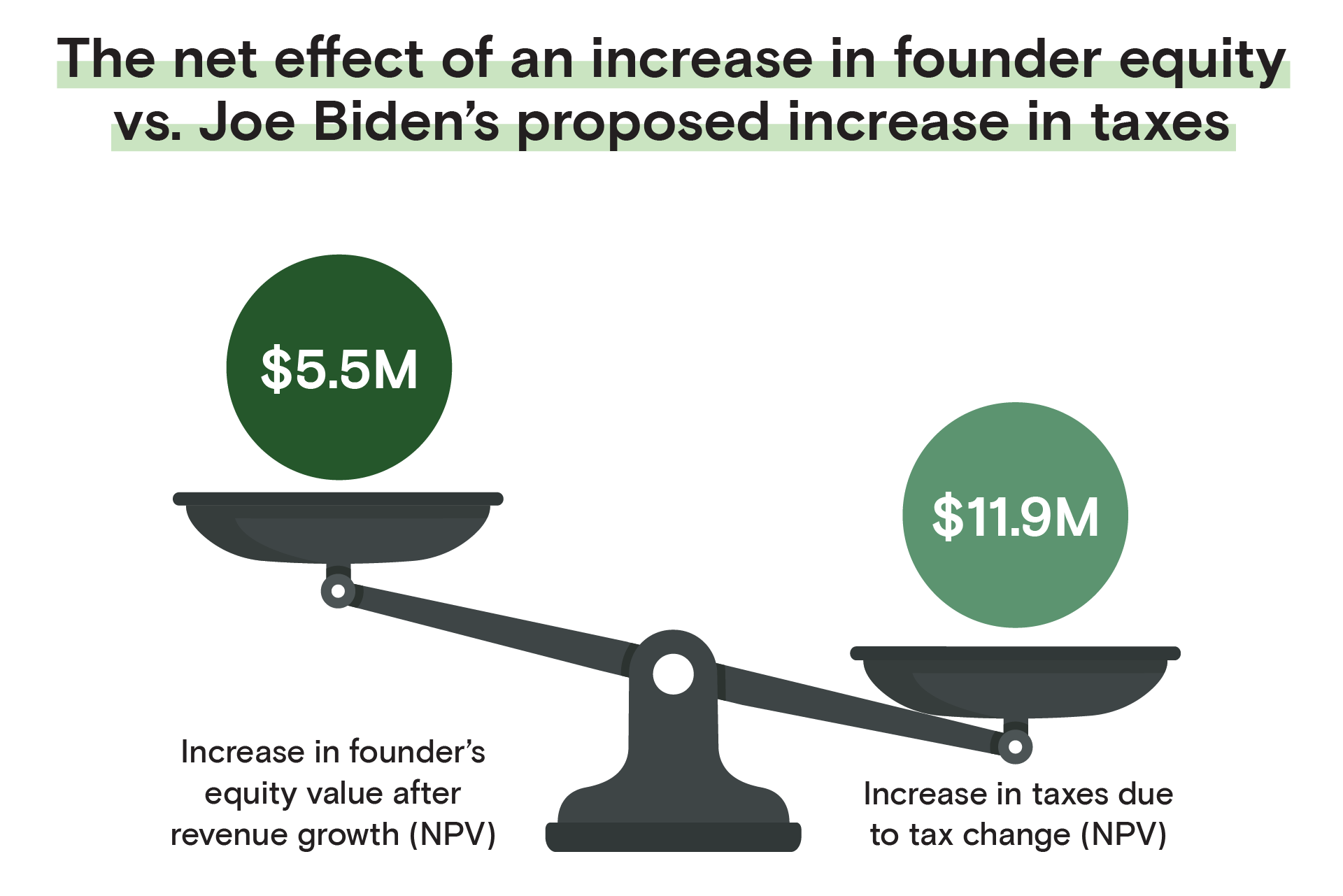

Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase. The bank said razor-thin majorities in the House and Senate would make a big. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

The Treasury in May reported a 308 billion surplus for April a monthly record with receipts hitting 864 billion which more than doubled the previous years amount. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. In all Canadians realized 729 billion in taxable capital gains.

Of the total 546 percent was declared by taxpayers with incomes over 250000. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Crypto Capital Gains And Tax Rates 2022

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

How Biden An Increasing Capital Gains Tax Affects Oz Investing

Short Term Capital Gains Tax Rate For 2021

How Are Capital Gains Taxed Tax Policy Center

For Founders The Implications Of Joe Biden S Proposed Tax Code

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

What You Need To Know About Capital Gains Tax

Florida Real Estate Taxes What You Need To Know

Capital Gains Tax In The United States Wikipedia

Managing Tax Rate Uncertainty Russell Investments